Home affordability at decadal best in 2021: Knight Frank India Affordability Index Affordability ratio in Bengaluru improved from 57% in 2012 to 26% in 2021

Home affordability at decadal best in 2021: Knight Frank India Affordability Index

Affordability ratio in Bengaluru improved from 57% in 2012 to 26% in 2021

· Affordability at historic best across cities in 2021

· Ahmedabad and Pune most affordable Indian housing markets of 2021

· Affordability ratio in NCR improved from 38% in 2020 to 28% in 2021

· Mumbai emerges as biggest gainer on affordability since 2010

Bengaluru, January 16 , 2022: In its annual proprietary study, the Affordability Index 2021, Knight Frank notes that Indian markets are at their decadal best in terms of housing affordability. All markets, except Mumbai, are recorded to be well below the threshold of affordability set at 50% ratio. Ahmedabad emerged the most affordable housing market in the country with an affordability ratio of 20% followed by Pune and Chennai at 24% and 25% respectively in 2021. Mumbai was the only one that recorded higher than threshold affordability ratio at 53%, however, it has improved the most since 2011.

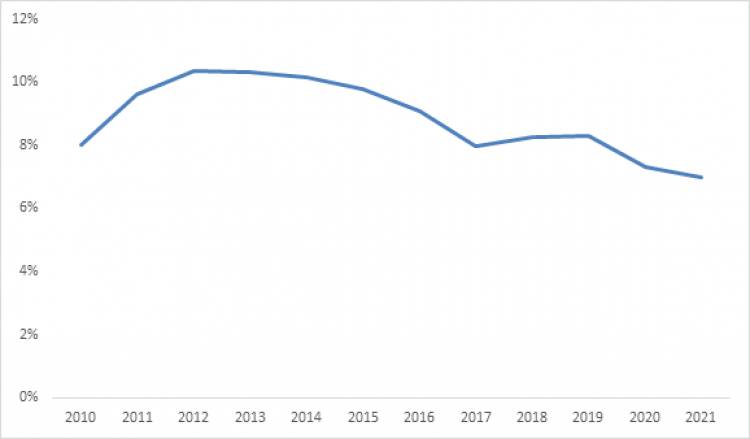

Knight Frank's proprietary Affordability Index, which tracks the EMI (Equated Monthly Installment) to total income ratio for an average household, has shown a meaningful improvement in affordability since 2010. Despite the pandemic period since early 2020, which has created disruptions in household incomes, housing affordability has further improved. Decline in house prices and multi-decade low home loan interest rates have helped improve housing affordability in 2021.

The Knight Frank Affordability Index captures movement in key constituents like property prices, home loan interest rate and average household income to determine the buyers’ ability to purchase a house. Since banks underwrite home loans when the EMI to Income is under 50%, on that account, existing income and average ticket-size metrics across seven out of eight markets make it possible for a homebuyer to easily finance their home purchase.

Affordability Index (EMI/ Income ratio)

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Mumbai

93%

100%

98%

95%

97%

94%

92%

73%

68%

66%

60%

53%

NCR

53%

64%

70%

64%

57%

51%

44%

35%

35%

34%

38%

28%

Bengaluru

48%

53%

57%

56%

52%

48%

43%

36%

34%

32%

28%

26%

Pune

39%

43%

46%

43%

43%

38%

34%

29%

28%

28%

26%

24%

Chennai

51%

55%

57%

52%

47%

43%

39%

34%

31%

29%

26%

25%

Hyderabad

47%

53%

49%

47%

42%

39%

37%

33%

35%

33%

31%

29%

Kolkata

45%

48%

53%

53%

48%

44%

41%

35%

33%

31%

29%

25%

Ahmedabad

46%

48%

46%

42%

40%

36%

34%

28%

27%

25%

23%

20%

Note: City-wide average affordability statistics cannot highlight disparities in housing costs within sub-markets or across the income spectrum.

Source: Knight Frank Research

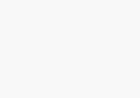

Shishir Baijal, Chairman and Managing Director, Knight Frank India said, “Over the last decade housing market has undergone a structural transformation on both demand as well as supply side. This has made the environment for home buying relatively attractive and safe. However, the key catalyst remained the - affordability, which has witnessed gradual improvement since 2015. For most part of the last 5-6 years residential prices corrected leading to better affordability, however, the recent reduction in home loan interest rate to below 6.5% has been a deciding factor in the significant improvement in home affordability in the last 24 months. No doubt it has taken a pandemic for the market to turn the corner and lift homebuyer sentiment, which is now evident across the country. This is, therefore, a great time for potential buyers to purchase a home given that all factors, in terms of regulatory environment, the pricing as well as home loan rates are conducive. We believe a combination of best affordability levels and a pick-up in economy will serve as key catalysts for the country’s housing market next year.

EMI to Household Income Chart

cid:image004.png@01D7FCAE.03D79C90

Source: Knight Frank Research

· Note: The Knight Frank Affordability Index indicates the proportion of income that a household requires, to fund the monthly instalment (EMI) of a housing unit in a particular city. So, a Knight Frank Affordability index level of 40% for a city implies that on an average, households in that city need to spend 40% of their income to fund the EMI of housing loan for that unit. An EMI/ Income ratio over 50% is considered unaffordable as it is the limit beyond which banks rarely underwrite a mortgage.

Assumptions

o EMI, housing unit size and price/ sq ft represent city-level averages.

o EMI:

§ Loan Tenure – 20 years

§ Loan to Value – 80%

§ Home loan interest rate - Average home loan rates

o Area of housing unit: House size is fixed for each city across the years, but varies within different cities taking into account the average size preference for each city.

o Housing Price: Median housing price for that city

Housing loan interest rate chart

cid:image006.png@01D7FCAE.03D79C90

Source: Knight Frank Research

- End -

About Knight Frank

Knight Frank LLP is a leading independent, global property consultancy. Headquartered in London, Knight Frank has more than 20,000 people operating from over 488 offices across 57 markets. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit www.knightfrank.com.

Knight Frank India is headquartered in Mumbai and has more than 1,200 experts across Bangalore, Delhi, Pune, Hyderabad, Chennai, Kolkata and Ahmedabad. Backed by strong research and analytics, our experts offer a comprehensive range of real estate services across advisory, valuation and consulting, transactions (residential, commercial, retail, hospitality, land & capitals), facilities management and project management. For more information, visit www.knightfrank.co.in