Go Fashion (India) Limited Initial Public Offer to open on Wednesday November 17, 2021

Go Fashion (India) Limited Initial Public Offer to open on Wednesday November 17, 2021

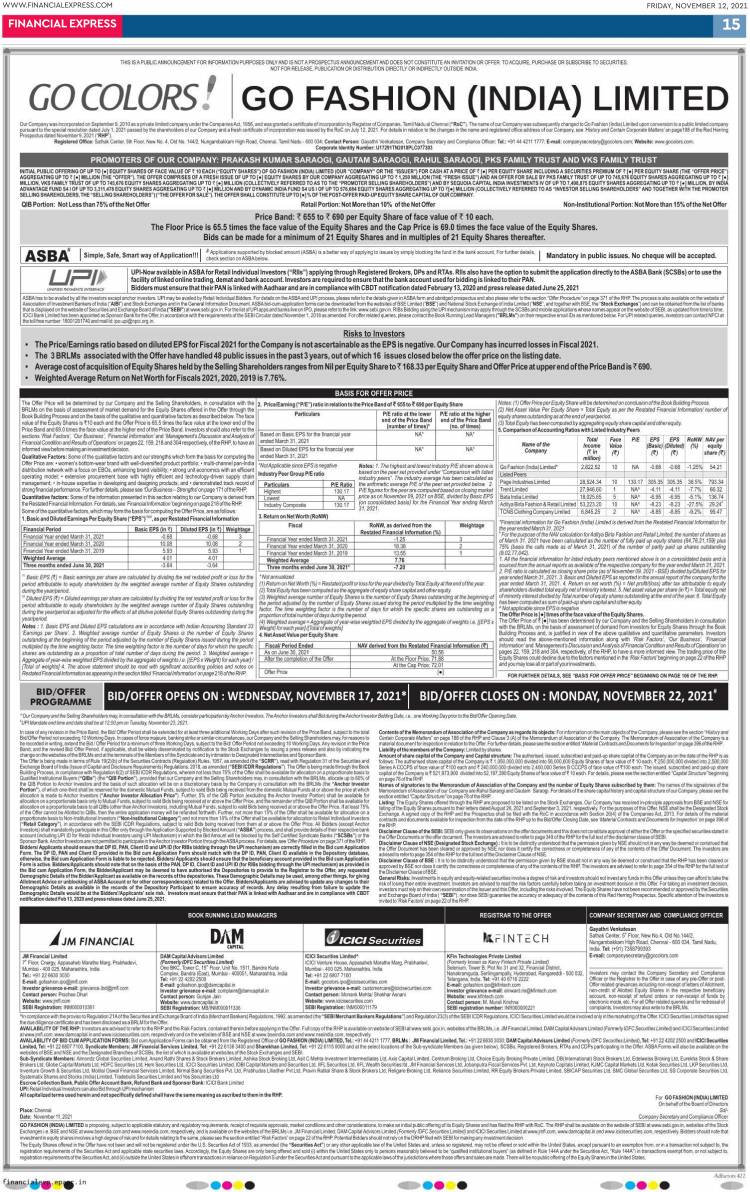

· Price Band fixed at ₹655 to ₹690 per Equity Share of face value of ₹10 each of Go Fashion (India) Limited

· Offer to remain open from Wednesday, November 17, 2021 to Monday, November 22, 2021

· Bids can be made for a minimum of 21 Equity Shares and in multiples of 21 Equity Shares thereafter

Go Fashion (India) Limited (“Go Fashion” or the “Company”), a women’s bottom-wear brand in India, with a market share of approximately 8% in the branded women’s bottom-wear market in Fiscal 2020, plans to open its Initial Public Offering (the “Offer”) on November 17, 2021.

The Price Band of the Offer has been fixed at ₹655 to ₹690 per Equity Share of face of ₹10 each. Bids can be made for a minimum of 21 Equity Shares and in multiples of 21 Equity Shares thereafter.

The Offer consists equity shares of face value of ₹10 each of Go Fashion (India) Limited comprising of a fresh issue of equity shares by the company aggregating up to ₹ 1,250 million (the “Fresh Issue”) and an offer for sale by PKS Family Trust of up to 745,676 equity shares, VKS Family Trust of up to 745,676 equity shares aggregating (collectively referred to as to the “Promoter Selling Shareholders”) and by Sequoia Capital India Investments IV of up to 7,498,875 equity shares, by India Advantage Fund S4 I of up to 3,311,478 equity shares and by Dynamic India Fund S4 US I of up to 576,684 equity shares (collectively referred to as “Investor Selling Shareholders”).

The Offer is being made in terms of Rule 19(2)(b) of the Securities Contracts (Regulation) Rules, 1957, as amended (the “SCRR”), read with Regulation 31 of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, as amended (“SEBI ICDR Regulations”). The Offer is being made through the Book Building Process, in compliance with Regulation 6(2) of SEBI ICDR Regulations, wherein not less than 75% of the Offer shall be available for allocation on a proportionate basis to Qualified Institutional Buyers (“QIBs”) (the “QIB Portion”), provided that the Company and the Selling Shareholders may, in consultation with the BRLMs, allocate up to 60% of the QIB Portion to Anchor Investors and the basis of such allocation will be on a discretionary basis by the Company in consultation with the BRLMs (the “Anchor Investor Portion”), of which one-third shall be reserved for the domestic Mutual Funds, subject to valid Bids being received from the domestic Mutual Funds at or above the price at which allocation is made to Anchor Investors (“Anchor Investor Allocation Price”). Further, 5% of the QIB Portion (excluding the Anchor Investor Portion) shall be available for allocation on a proportionate basis only to Mutual Funds, subject to valid Bids being received at or above the Offer Price, and the remainder of the QIB Portion shall be available for allocation on a proportionate basis to all QIBs (other than Anchor Investors), including Mutual Funds, subject to valid Bids being received at or above the Offer Price. If at least 75% of the Offer cannot be Allotted to QIBs, then the entire application money will be refunded forthwith.

Further, not more than 15% of the Offer shall be available for allocation on a proportionate basis to Non-Institutional Investors (“Non-Institutional Category”) and not more than 10% of the Offer shall be available for allocation to Retail Individual Investors (“Retail Category”), in accordance with the SEBI ICDR Regulations, subject to valid Bids being received from them at or above the Offer Price. All Bidders (except Anchor Investors) shall mandatorily participate in this Offer only through the Application Supported by Blocked Amount (“ASBA”) process, and shall provide details of their respective bank account (including UPI ID for Retail Individual Investors using UPI Mechanism) in which the Bid Amount will be blocked by the Self Certified Syndicate Banks (“SCSBs”) or the Sponsor Bank. Anchor Investors are not permitted to participate in the Anchor Investor Portion through the ASBA process.

The Net Proceeds from the Fresh Issue are proposed to be utilised for (i) Funding roll out of 120 new EBOs; (ii) Funding working capital requirements; and (iii) General corporate purposes.

The Equity Shares offered in this Offer are proposed to be listed at both BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”, together with BSE, the “Stock Exchanges”) post the listing.

JM Financial Limited, DAM Capital Advisors Limited (Formerly IDFC Securities Limited) and ICICI Securities Limited^ are the Book Running Lead Managers to the Offer.

^In compliance with the proviso to Regulation 21A of the Securities and Exchange Board of India (Merchant Bankers) Regulations, 1992, as amended (the “SEBI Merchant Bankers Regulations”) and Regulation 23(3) of the SEBI ICDR Regulations, ICICI Securities Limited would be involved only in the marketing of the Offer. ICICI Securities Limited has signed the due diligence certificate and has been disclosed as a BRLM for the Offer.

Disclaimers:

GO FASHION (INDIA) LIMITED is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offering of its Equity Shares and has filed the RHP with RoC. The RHP shall be available on the website of SEBI at www.sebi.gov.in, websites of the Stock Exchanges i.e. BSE and NSE at www.bseindia.com and www.nseindia.com, respectively, and is available on the websites of the BRLMs i.e. JM Financial Limited, DAM Capital Advisors Limited (Formerly IDFC Securities Limited) and ICICI Securities Limited at www.jmfl.com, www.damcapital.in and www.icicisecurities.com, respectively. Bidders should note that investment in equity shares involves a high degree of risk and for details relating to the same, please see the section entitled “Risk Factors” on page 22 of the RHP. Potential Bidders should not rely on the DRHP filed with SEBI for making any investment decision.

The Equity Shares offered in the Offer have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or any other applicable law of the United States and, unless so registered, may not be offered or sold within the United States, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. Accordingly, the Equity Shares are only being offered and sold (i) within the United States only to persons reasonably believed to be “qualified institutional buyers” (as defined in Rule 144A under the Securities Act, “Rule 144A”) in transactions exempt from, or not subject to, registration requirements of the Securities Act, and (ii) outside the

United States in offshore transactions in reliance on Regulation S under the Securities Act and pursuant to the applicable laws of the jurisdictions where those offers and sales are made. There will be no public offering of the Equity Shares in the United States.